Some things never change…

Like the want for would-be entrepreneurs to enter the real estate market and make riches.

With so many entrepreneurs who want to enter the real estate market, how can you enter the market, become successful, all with little to no money out of your pocket?

Well before we answer this question, you must ask yourself the question: Are you ready to engage in a long term plan to make a dent in the real estate market?

The reason why this question is so central to your real estate goals is because the vast majority of entrepreneurs who intend on working in the real estate market fail and ultimately waste their time and make no money.

Why is this important? It’s important for a few reasons, but most importantly because if you intend on making money in a month or two in real estate, dream on, it’s impossible.

If you really want to make money in real estate, particularly when you have no money, be prepared to engage in a battle every day.

There simply is no other way.

There truly is no market more competitive than the real estate field. This can either be a good or bad thing. ( to change)

It can be a good thing in a sense because if you have what it takes, your competitors will fizzle out as you are making your way to the top.

Clearly it could be a bad thing, because if you don’t do what’s necessary you simply won’t make it.

Now that we got that out of the way, let’s talk about the time tested strategies you can use to enter and take over your local real estate market.

While the article’s contents have been fully utilized by me as me and my team have successfully closed over 10 investment purchases for me personally and over a 150 purchases for other investors, before the age of 25. Each strategy must be fully utilized in order to get results.

In real estate there simply is no magic pill that replaces the organic time it takes to reach out to as many buyers, sellers, agents, banks, and others as is necessary.

Your ability to become established in your local market requires knowing all aspects of real estate, which will be discussed in future posts.

Be prepared to do the heavy lifting because your financial future depends on it.

In this post, I’m going to show you the 13 steps you can use to successfully get started in the real estate market.

Whatever your goals, your inspirations, be prepared for the battle of a lifetime.

Believe in yourself and your hard work because after a few short years, and hundreds of thousands of dollars later, or maybe millions like in my case, your efforts will have been fully worth it.

Notice, I did not say a few short months above, because that is unrealistic, and if there’s anything I’ve learned in life it’s to not be unrealistic.

Unrealistic goals lead to disappointment and create a cycle of false expectations, which in turn will make you quit, because you thought you were not capable.

Lets get started!

1. Become Established with Local Real Estate Agents: 5 Direct Benefits

Use the success of others as an asset. What does this mean for you?

Talk to as many local real estate agents as possible.

Most agents spend a significant amount of time and money in advertising their business. By working with agents you can leverage the money they spend on marketing, by having the agent refer you business they originate through their marketing efforts.

Why is this important?

Because you can use the agents marketing budget to your advantage, by having them refer potential investment properties to you.

This means that without spending a dime, you will have access to deals that could potentially be very profitable. The only fee you would be responsible for paying is the agent fee upon the close of the transaction.

This proves invaluable for two main reasons.

The first reason is you can find investment opportunities without doing any work other than talking to the agent.

The second reason is you can locate investment opportunities without paying for the list of properties.

Local agents spend almost all of their time out on the field and get feedback from buyers, sellers, other agents, and other real estate professionals.

Leverage the current market knowledge of agents to your advantage and listen to their opinions.

Because each local market is different, what is apparent in one market may not be the same in other location.

By talking to local agents, you will have an advanced understanding of the local conditions on the ground.

This includes learning about local property values, the economy, whether the market is a buyer or seller’s market at the current time and overall gaging what type of deals are out there.

Additionally, having real connections with reputable agent’s means when the time comes and you are ready to buy or sale a property, you will have already established yourself with agents who can give you deals before the general market.

Ask questions such as:

Sample Questions to Ask Agents

• Are there more buyers or sellers in the current market

• How long do the average deals stay on the market

• What is the average property value

• Where is the market headed

• When will property values increase or decrease

• Are banks giving out loans that make the buying and selling process possible

How does talking to other agents benefit you?

In addition to learning for free, agents know many other agents which means if you have a specific request such as wanting to buy a property for less than $100,000, there is high likelihood that the agent you are in good standing with has the type of deal you are looking for or can refer you to an agent who has the deal you require.

Although talking to agents may not immediately prove fruitful, in the long term, knowing agents proves to be invaluable.

In my specific case, real estate agents benefit me tremendously. How is this you may ask?

Well for one, when an agent comes across a good deal, they give me the deal before the general market because they know based on their experience with me in the past, if they bring me a solid business investment, I or one of my investors will purchase the property, which means they get paid fast.

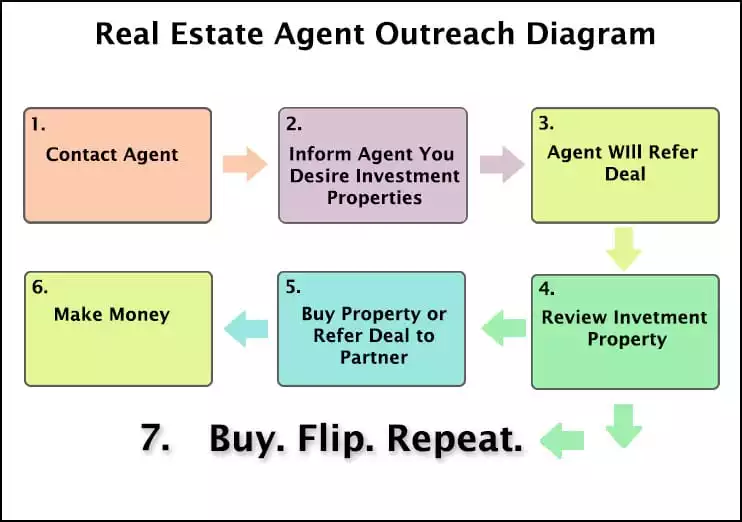

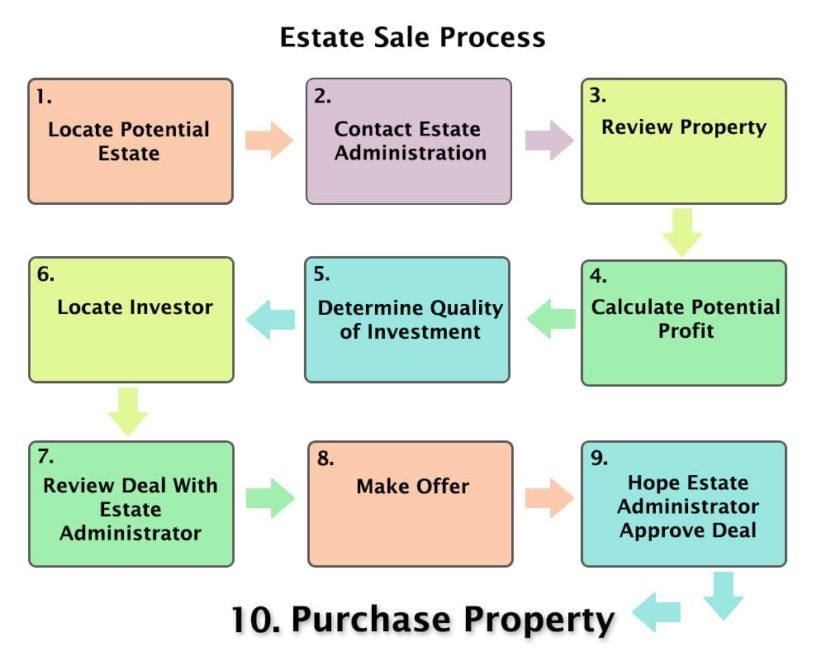

The following diagram is the process I use to leverage agents’ knowledge of the market to refer me properties.

Every business dynamic must benefit both parties.

This type of business dynamic benefits the agent because they know if they refer me the deal they will get a commission in a short period of time and it benefits me because I get a solid deal before the rest of the market.

Top Benefits of Becoming Established with Local Agents

A. Ability to build a network of agents working for you for free

B. First dibs on properties before they become available to the general market

C. Ability to negotiate a purchase at a discount

D. Ability to be aware of high potential deals

E. Ability to have more eyes on the ground

A. Ability to Build a Network of Agents Working for you for Free

Being connected with local agents is one of the most important things you need to develop to become successful in real estate.

If you develop a group of local real estate agents who refer you deals you will be on your way to finding solid investment properties.

To build a network of local agents that work for you for free begin by contacting as many reputable local agents in a local market.

How can you do this?

- Drive through the local community and find all the properties listed and contact all of the agents

- Go to local real estate office and talk to as many agents as possible

- Go to broker houses

- Go to open houses

When you meet agents tell them that you are a real estate investor and that you have access to cash and can close quick.

Tell the agent that you want to buy properties that are at least 10 percent below market value.

In my experience this is one of the best ways to establish yourself with agents.

Because agents make money on commission and you tell the buyer you can close quickly they are likely to refer you the listing.

B. First Dibs on Properties Before they Become Available to the General Market

When you present yourself to an agent as a real estate investor the agent knows you are serious and want to close deals fast.

Ultimately, agents love investors who want to buy fast because that means they get paid fast.

If you establish yourself with agents in the local community, you are likely to get referrals to great investment properties before they become available to the general market.

A few of my original deals which really got my foot in the real estate market were referred to me by agents.

In these examples, the agent told me about a short sale listing he had and needed a buyer.

Because the deal was a short sale, the agent was able to get a 20 percent discount on the sale, which gave me immediate equity.

For me this meant money in door the first day, which was only made possible because of the agent referring me the deal.

Although at the time I did not have the capital to close the deal, I did know a few investors who wanted to purchase investment property at a discount.

I signed the offer and the investors who were my family friend’s transferred me the money and we purchased the property.

C. Ability to Negotiate a Purchase at a Discount

If an agent knows you have the ability to close their deal they will negotiate with their seller on your behalf.

Agents have the ears of the seller and oftentimes can convince them to reduce the price of the listing which benefits you the real estate investor.

This means you can get properties at discounts.

By having developed relationships with local agents, agents will work to get you deals because it directly benefits the agent as well.

D. Ability to Be Aware of High Potential Deals

Because you can’t be everywhere at all times, it helps to have agents inform you of high potential deals that you may not be aware of.

My experience has shown me that however hard I work, I can still never find as many deals as others can find for me.

Why is this the case?

I am only one person and can only drive to so many places and view so many property profiles before the day is over.

Agents that partner with me provide me a solid stream of new potential deals that I can make money on when I am not aware of those deals.

Literally, this strategy is so effective because I utilize the knowledge and awareness of other agents deals for my own benefit.

E. Ability to Have More Eyes on the Ground

In real estate you need as many eyes on the ground working for you as possible.

Agents spend more time in the local real estate than do any other group of people.

They are the perfect people to give you information about the local market and keep you aware of business deals.

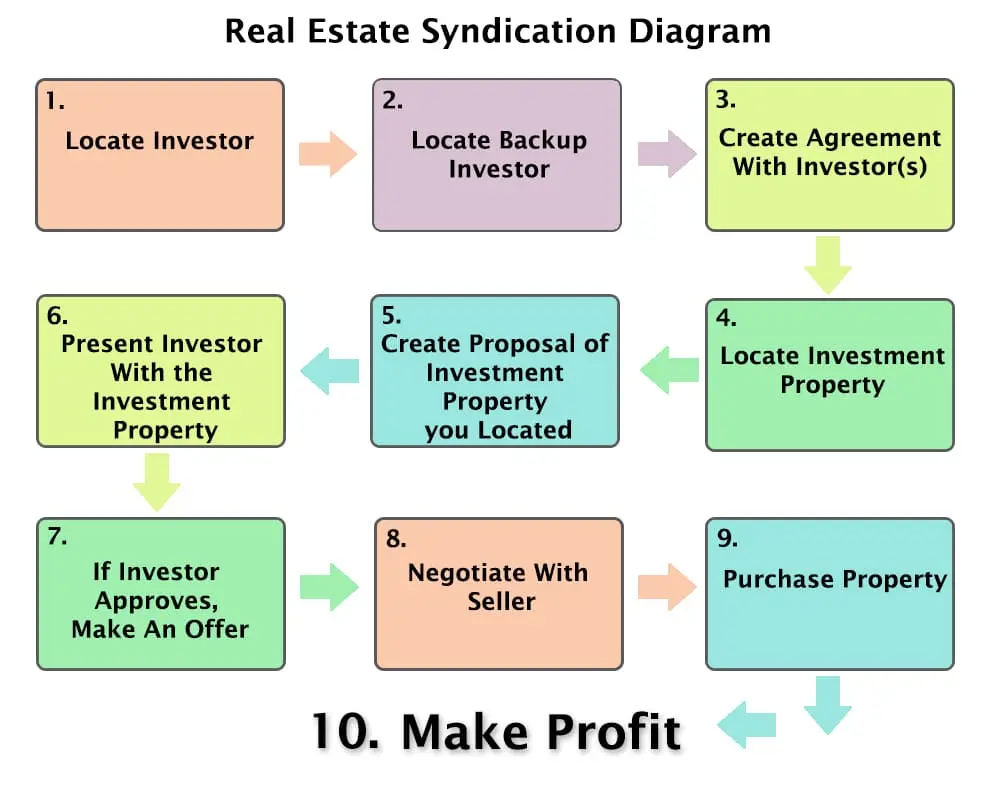

2. Real Estate Syndication – Owning Real Estate with No Capital

If you have no money to start in real estate, which is the vast majority of you guys reading this, then real estate syndication is the best place for you to get your foot in the door.

Real estate syndication is when you get a group of investors or one investor contribute/s towards the purchase of a property and another party manages the purchase and the buying/selling/renting process.

This strategy works great because you can own property or a percentage of it without any money out of your own pocket.

This is what I originally did to own my first piece of property and till this day it remains the best thing I ever did in my professional career because it gave me the opportunity to make money in real estate without any money because at the time I had no money to invest.

This strategy is the number one way to make money in real estate if you have no money to invest.

The beauty behind this strategy is there are many people who want to invest in real estate, except do not know where to find properties.

This is where you come in.

If you can find profitable investment properties and connect them with investors, you will own a percentage of the property and/or make a commission based on the purchase price.

If you do have money, syndication is still an effective way to make money by using investor capital to buy larger and more lucrative deals than would otherwise be possible with only one investor.

This allows you to make more money in less time.

In a syndication deal, one partner brings forward the deal, while the other funds the deal or a larger portion of the deal and profits are split accordingly.

This is perfect for people who have no money.

The syndicator will get anywhere between 10-50% of all profits depending on the profit in the deal, the roles of the parties involved, and who found the deal.

There are two main ways to make money doing syndication.

- The first is buying a property and developing for the purpose of collecting rental income

- The second is buying property with the intent to sell the property for a profit

I use both strategies and the strategy I use at a given time is dependent on the profit, my current financial situation, how expensive the investment is, and the partner.

The syndicating party is the party who brings forward the deal. Syndicators can charge 1-3% in acquisition fees and the 10-50% of the total profit as described above.

Not bad considering you don’t have to put any money down.

The chart below is the ratio of the type of buyers who purchase investment properties.

Wow!!!

As you can see, about 1 in 5 real estate investment purchases had some form of syndication where the syndicator became partial owner of a property with no money out of their pocket, except their effort to find the property.

Example of Deal I Did

The deal below is one of the first deals I successfully completed in real estate and I currently still own this property today and collect rental income.

Short Sale Purchase

Purchase Price: $195,000

True Value: $295,000

Cost to Develop: Approximately $70,000

Total Price: $265,000

Value After Development: $450,000-$500,000 2 years later

Rental Income: $4,100 monthly income

Cap Rate: Nearly 20 percent

While the above deal has a ridiculously high cap rate because I bought it as a short sale purchase, deals like this are oftentimes available.

The rate has become 20 percent because of the increase in property values in the last few years, in addition to fact that my partner and I invested $70,000 to increase its value.

3. Bird Dogging – How to Get Rewarded for Finding Good Deals

Bird dogging in real estate refers to a party who spends time locating properties that have potential and connecting the deals with investors to fund.

The bird dogger is the party who locates the property in return for a fee or a percentage of the profit by referring the deal to an investor who has the money to purchase the property.

This concept is nothing new; in fact it’s been around forever.

I originally learned about this concept from my father who has a keen eye for finding properties with potential.

My father taught me through the years what to look for in a good deal and after learning I began connecting solid business investments with investors who have the money to invest.

Buying property using the bird dog method is not easy, but who cares because nothing ever worth it is easy.

It is definitely time consuming and you will likely go through a few failed deals before one closes.

Locating a solid business investment and finding a suitable buyer will not happen overnight.

It takes a bit of luck, timing, and opportunity to find a suitable property and locating a willing buyer who will pay you. At the end however the large payout makes all of the effort well worth it.

To become a bird dogger, I recommend you spend some time working for an investor who has a good eye for properties with potential.

Our team noticed an interesting post by biggerpockets.com, titled Why the Concept of Being a Real Estate Birddog is a Scam.

We couldn’t help but notice the party who wrote the post claim that the concept of bird dogging is a scam.

He goes on to say the following:

****Picture: I’m going to use personal experience from this. I’ve had numerous people contact me who ask if they can be a bird dog for me and locate deals. It’s no risk to me since I would never pay until I had a deal in hand, so of course I’m going to say “Yes, I’d be happy for you to be a bird dog for me”. I’ve had people from both in my area, and then out of my area (in fact, some that are in different states!) request to be a bird dog. No matter where they are from, they all have produced the SAME exact result.

This result has been so consistent, that now when people ask if they can be my bird dog, I have a boilerplate response I give them, and so far 100% of them I’ve never heard back from. So what is this result?

They send me listings from the MLS. Bluntly put, this brings NO VALUE to the table. I am a licensed real estate agent, so the MLS is my home. Even if I wasn’t though, anyone can log onto a local Realtor site and do a search.

I couldn’t disagree with the above statement any more.

The author claims a bird dogger brings no value to the table and that he has never had success with bird dogging.

The author further states that because he has access to the MLS he can find all the good deals.

If that were the case then how come he hasn’t found all the good deals for himself?

It’s because what he is saying is factually false.

A bird dogger is essentially a third party who spends time finding deals all the time.

Because I can’t work 24/7, I need others to locate properties for me and my team and that’s what bird doggers get paid to do, so to call it a scam means he has had no success using the strategy and probably minimal success to begin with.

That’s his experience and not mine or the many people I know who have successfully found deals for themselves, other investors and made money using bird doggers who originated the transaction.

How do I know this strategy works?

For two reasons.

The first reason is because I pay bird doggers a fee to refer me and my team properties so I definitely see the value in paying people for referring me solid business investments.

The second reason is because I bird dog larger, more expensive deals to high network investors who pay me a fee in return for me referring them a deal.

The point I want to make about his post is just because someone hasn’t successfully done a deal using such a technique doesn’t mean it’s impossible or unlikely.

Maybe that’s why he isn’t that successful in real estate and can’t claim to have owned or found hundreds of properties throughout the years for himself and others.

In addition to the article being false, the reason why I’ve included the author’s post in my post is to help you learn that there will always be negative people around you that try to bring you down, or even those who will write off the cusp content for the purpose of reeling in viewers with strong and misleading titles.

4. Farming the Local Market – Finding Seller’s to Give you More Deals

Farming the local real estate market involves sending emails, newsletters, and even doing door to door knocking to inform property owners of your intention to buy their properties or assign them to investors.

You can use this strategy in two ways.

- The first is to get homeowners to sell you a property to purchase for yourself.

- The second is to sale the home to an investor you work with.

Your goals and the letter you would send to a property owner in a lead farming pitch will vary based on whether you are soliciting the seller as a buyer or as an investor.

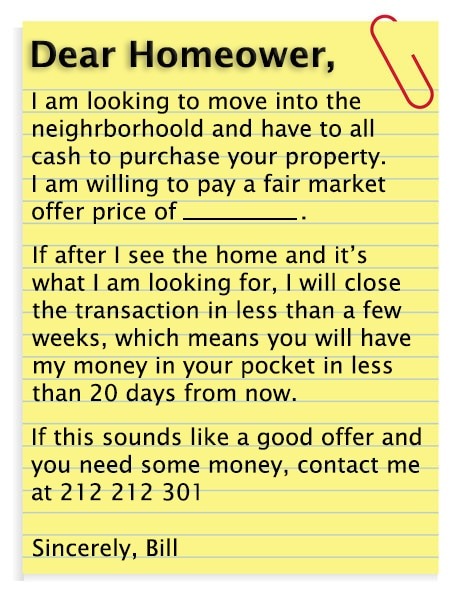

If you are using the home buyer pitch you can write a letter similar to the sample letter below.

Sample Letter to Convince Owner to Sale Property (Home Buyer)

While the vast majority of homeowners will not want to sale their house, even if one percent of homeowners you reach want or need to sale their property, you have just landed yourself a deal.

I can’t emphasize this enough: If you are just beginning in real estate, your biggest concern should be to get yourself your first deal.

Do whatever you can in your power to make the first deal happen.

Each deal in real estate is so valuable and delivers such a high profit that if you can get that first deal, you’re well on your way to reaching your goals by getting more.

Once you can get one deal, however painstaking it may be, your next deals will come much easier.

The best way to begin lead farming is to target a specific real estate market. Put extreme focus in that particular market.

Be sure that the neighborhood, small city, or community you are targeting has enough homes to reach a solid amount of homeowners to test your lead farming strategy.

Another angle you can take is if you are telling the homeowner you are an investor.

Sample Letter to Convince Owner to Sale Property (Investor)

Bottom line,

No one can say local real estate lead farming doesn’t work.

People will always need money and what is the best way they can the most amount of money?

By selling their homes and this is where you come in.

Lead farming allows you to find homeowners who may have considered selling their home in the past and those who need money, or need to relocate.

This is perfect for you being because you could be the party who purchases their home for a discounted price for yourself or with an investor.

People move all the time which is why this method works. If people have to leave, need to sale their homes, relocate to another city, or something else, you can be the party who fulfills that void by buying their property or assigning its rights to an investor for a fee.

5. Partner up with Someone – Focus on Lasting Partnerships that Add Value

You can never have enough eyes in the real estate market. And that means you need laser-like focus to quickly find deals before others snatch them up.

Although there are almost always more than enough deals to go around, the vast majority of deals are taken by a select few groups of people or companies because of their buying power and ability to find deals before others. (insert link) (maybe http://activerain.com/blogsview/3720953/the-80-20-rule—should-it-be-called-the-90-10-rule–) (our own evidence?)- poll conducted

-Chart (of 95% vs 5% in real estate)

You will certainly be facing a lot of stiff competition in the real estate market.

In order to compete with wealthier and larger teams to find good deals, you need someone who’s got your back and can help you maximize your time, while you help them do the same.

As previously talked about, there is never enough time in the day to go through enough deals by yourself.

You need someone who can increase your work capacity.

One of the most effective things you can do is to become partners with a like minded individual who has the game goals as you.

Your partner can be the missing link in your business by catapulting all your efforts at a much faster rate. This benefits both party’s.

While it does not matter whether the person is a silent partner who has capital to invest or a partner with no money whose sole skill and responsibility is to find homes, what is important is that your partner can directly assist you in reaching your goals.

In real estate your partnerships should be created with the intent of doing long term business with that partner.

Successful partnerships can help you:

- access more deals

- enter new markets

- have more eyes on available properties, and prevent competitors from finding deals before you.

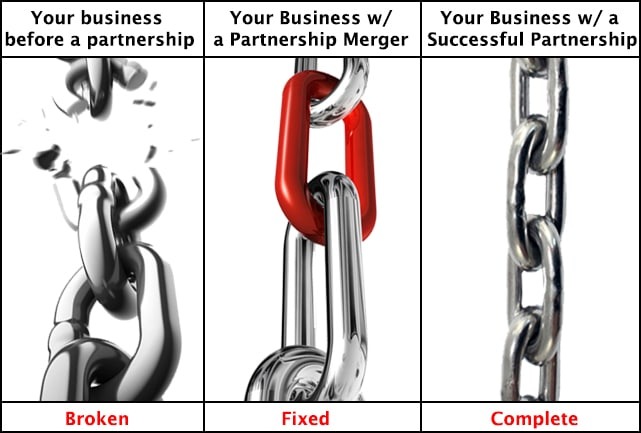

Partnerships help strengthen aspects of a business that are weak.

Partnership Evolution Chart

Partnerships help you fill all the missing links to your real estate business.

In real estate this may include: inability to find profitable deals, inability to see potential, real estate marketing, calculating profit

Why Real Estate Partnerships are So Important

Partnerships give members of the partnership the ability to achieve would could otherwise not be possible with one person.

Top Benefits of Partnerships

- More eyes equals more potential deals

- More people equals more time finding more deals

- Opportunities to improve in areas of weakness by utilizing the other partners strengths

- Additional funding avenues

- More contacts to leverage

- Business credit, when one party may not have access to credit or financing

- Increased capacity

- Increased knowledge

Only real relationships with a mutual understanding work, particularly in a field as competitive and conniving as real estate.

How can you actually use this?

Find a friend, business associate, family friend, or relative who you connect with on a deep level.

For some this may be difficult or impossible.

But if you are lucky like me you will have someone in your life who you know who wants to reach the same goal as you.

Leverage the same desires they have as you and form a partnership where each partner has a role to find as many properties and investors as possible with the ultimate goal of buying and selling as many properties as possible.

Where did this work in the real world?

The world’s most valuable companies were not created by one individual.

They were almost always created by two.

Example of Successful Partnerships

1. Apple: Steve Jobs and Steve Wozniak

2. Google: Larry Page and Sergey Brin

3. Microsoft: Bill Gates and Paul Allen

4. Home Depot: Bernie Marcus and Arthur Blank

5. Hewlett Packard: Bill Hewlett and David Packard

6. Ben and Jerry’s: Ben Cohen and Jerry Greenfield

We can go on and on about the most successful partnerships of all time.

But one thing you must notice above is all of the richest people in the world are practically on that list and all of their success occurred as a result of them creating partnerships.

Nothing can hurt the chances of a fruitful partnership more than partners who don’t have the same vision.

It is critical that both or all partners have the same short and long term vision.

How did this work for me?

I started working with my sister when I was 16 years old.

My sister had previously worked in the mortgage market and she was consistently a top five mortgage producer in all of Southern California before she was 26.

My sister is 10 years older than me, so I grew up watching my sister excel in her field and this motivated me to be like her.

When the mortgage market collapsed in 2007, my sister and I changed gears and went into the real estate market, which is when we started buying property for ourselves and other investors.

In my experience partnerships with a like minded person works very well because in general in life, you cannot be a one man army in a competitive field of people who have more money and knowledge than you.

Two strong people are always more powerful than one strong person and that is the power of forming partnerships in real estate.

6. Form Relationships with Wealthy Investors – Increase your Odds of Finding Solid Deals

Your access to capital is the life’s blood of your real estate business.

The fact is that capital will be the reason for your success or the cause of your downfall.

If you have the capital to invest in real estate, regardless of if its yours or not, you will make significant money.

Partner up with someone who has money to invest and just watch as your income grows.

There is no magic formula to finding investors other than to talk to as many people about your real estate goals as possible.

This includes talking to friends, family friends, relative, business associates, and everyone you come across who may have the same financial goals as you.

Everyone wants to make money. Speak up and you will find that there may be someone you know who has money or knows someone who has money to invest with you.

If you find you don’t know anyone who has the capital to invest, go to real estate investors clubs, talk to agents, brokers, and other professionals about your goals and you likely find someone who wants to invest just like you or knows someone who wants to invest.

Remember,

If you want a successful partnership with someone, both parties need to contribute something to the partnership.

This could mean you have the ability to locate deals, while they have the capital to invest, or a combination of either.

7. Become Well Connected with Private Money Investors – Your Gateway to Money Heaven

If you are like most, you likely do not have the capital to invest in buying real estate.

If you don’t have money to invest in real estate, don’t worry it’s still more than possible to make money in real estate with other people’s capital.

How can this be done? You can attain a private money or hard money loan to purchase solid business investments.

If you do not have the credit or don’t think you can qualify, think again.

Unlike standard loans whose approval is based on difficult approval guidelines, the main component of qualifying for a hard money loan is to have a solid business investment to purchase and you will likely qualify.

Hard money lenders qualify borrowers based on the quality of the investment and the risk of deal you is to retain a loan for.

Hard money loans are used by real estate investors all the time because of their easy loan approval process and the fact that loans get approved much faster than traditional financing.

While the interest rate on hard money loans is higher, their increased costs are well worth the effort and value that you get out of qualifying for the loan and purchasing the investment.

Benefits of Hard Money Loans

- Easy loan approval

- Faster approvals than traditional financing

- Approvals for Borrowers with Bad Credit

- Approvals for Borrowers with Limited Income or Inability to Prove Income

Connect yourself with as many hard money private investors as possible, so when the time comes to buy something you have a solid lender who can fund your deals.

How do you become involved with hard money lenders?

To speak to and meet as many private money lenders as possible, search on the internet for lenders in your area and contact them.

Inform the lender that you are a prospective real estate buyer and that you need loans to purchased properties.

Ask the lender for their loan guidelines and the process.

Now, here’s the real story:

If you believe you cannot get approved for a loan, even with a hard money lender, it is advised that you either work with a partner and combine your credit to retain a hard money loan or use another individual’s credit to get approved for the loan.

In many situations, particularly when it is your first purchase, it may be advisable to offer the purchase to an investor who has the capital to qualify for a loan.

In real estate one of the major roadblocks you may face is the ability to get financing.

Why does this matter?

Because if you don’t have access to capital, you could have the best deal in the world and not be able to buy it because you can’t get a loan.

This matters because you could spend all the time in the world finding properties, but without a loan you likely will lose out on the deal, which is why getting approved for a loan is central to your long term goals of owning property.

Tip: If you are a first time investor or would-be real estate buyer, as indicated in previous sections, it is advised that you partner your efforts with a partner or with an associate/s who has the same goals as you.

This could involve coupling one’s capital together, using each other’s credit to qualify for loans, having more eyes on the market, and increasing the chance of finding and successfully closing escrow on a solid business investment.

Your ultimate goal of owning property needs to be achieved and this can only be done by exhausting all options available to you and this includes potentially partnering up with someone.

How did hard money directly benefit me?

When I found my first deal, I did not have the capital to purchase, however I did know of a solid private investor in Los Angeles who informed me that if I found a property at 10 percent below market value, that they would qualify me for a loan, which is what I did.

Without the loan my first deal would not have been possible.

8. Develop a Marketing Plan – Developing a Winning Strategy

As a prospective real estate professional, you must develop a marketing plan that delivers you a consistent stream of new business and a constant flow of new leads.

How can this be done?

While you may not have the money for the necessary advertising required to get as many deals as possible, you still have the ability to contact investors, sellers, agents, and others to find solid business investments.

Your marketing plan should have a large component that strictly involves contacting as many individuals as possible.

We have already discussed a few marketing strategies in this post including:

[su_box title=”Sample Marketing Strategy” style=”noise” box_color=”#ed0800″ title_color=”#000000″ radius=”5″ class=”boss-box”]

– Farming local market

– Contacting hard money or private investors

– Bird dogging

– Establishing yourself with agents

– Talking to real estate investors

-Internet Marketing

[/su_box]Use the proceeding list to develop your marketing strategy and as you gain money, invest the capital to increase the effectiveness of your marketing plan including having callers contact more agents, sellers, investors, and others.

Your marketing strategy should have a large component that involves searching the internet for available properties and finding reputable agents from their searches.

Why the Internet Needs to be a Big Component of your Marketing Campaign and How You Can Utilize the Internet to Work for You

(Above Chart: Large National Agent Survey Results Conducted by Agentjet)

9. Find Short Sales – Tapping Into the World of Deep Discounts

Short sales have been one of the best buying strategies of the last five years.

With an influx of foreclosures and banks who need to recoup their losses on loans that have been unpaid, banks have been selling property at huge discounts to the general market.

How does this benefit you?

You can find solid business investments everywhere.

Although in the last year or so there have been less available short sales on the market, if you do your research there are more than enough short sales left in the market to make money.

It is common to find short sales selling for below than up to 30 percent off of market value.

Wow!! Imagine finding a property and walking in with immediate equity. Now that is a deal.

Is this too good to be true?

While the results sound too good to be true, it is not out of the realm of possibility.

There have been hundreds of thousands of buyers all throughout the nation find suitable investment properties through short sales.

These buyers have made incredible money, simply by locating short sales and having the money or credit to purchase such deals.

Why do banks offer short sales at below market value?

Banks are in the business of collecting interest and do not want to retain properties with loans that are not making them money.

In order to get rid of the property, the banks reduce the value of the property, usually by at least 5-10% (most of the time even more) to sale the property as fast as possible.

The best part?

The best part is you can be the one who benefits from the bank’s problem by buying the property or referring it to an investor that has the capital to purchase it.

All the foreclosure activity in the United State’s must be addressed at some point and ultimately lenders will short sale a large volume of properties as short sales to the general market

10. Buy Real Estate from Estate Sales – Cashing in on Major Opportunities

Estate sales are another place where an investor could find a solid investment property.

The potential profit that can be made from estate sales is outstanding because the estate administrator’s goal is to sale property as soon as possible.

Who does this benefit?

The fact that estate administrators want to close out the estate as soon as possible benefits investors who can expect solid discounts on properties.

If it were only that easy….

Although estate sales are a tremendous source of real estate discounts, they are rare and hard to come by… However this does not mean they are not available.

The only downside to estate sales is that the investor needs to keep track about the status of the estate from beginning to end with the potential of not being able to get the property at the end.

This should not matter to you if your goal is to get your first deal because you will likely do everything in your power to get your foot in the market.

While the small percentage of my properties including my investors has been a result of estate sales, some of the largest profit making properties have been originated at an estate sale.

What does this go to show?

For one it shows that estate sales are rare and hard to come by because there are not that many estate sales.

Secondly it shows the great profit potential of estate sales.

11. Keep Track of Properties that Have a Notice of Default (N.O.D) – Staying on Top of Market Activity

Keeping track of properties that have a notice of default can help you make money in a couple of ways.

The first way to make money off of a notice of default is by being aware of properties that will or may go to short sale in the new few months.

This benefits you because before the general market is aware that a property will be sold you will know of the future sale, which means before others put offers, you will have already made an offer for yourself, your partner, or on behalf of an investor.

ex?

The second way to make money off of a notice of default is by contacting the homeowner and informing them of your desire to buy the property for yourself or your investor.

Negotiating directly with the owner allows to you potentially get a property for a discount because of the other party’s inability to pay the mortgage which means you will likely be able to buy the property from them for a discount.

Sellers will do this to avoid foreclosure which gives you an amazing opportunity to buy a property with instant equity.

As you can see in the chart below, a significant amount of properties that are in pre-closure (also referred to as Notice of Default) eventually become foreclosed or will be short sold.

12. Investing in an REIT – Minimizing Risk

Look there very may well be instances in the market when it may be difficult to locate solid real estate investments.

If this becomes a problem you can always invest money in a real estate investment trust (REIT). (or https://www.reit.com/investing/reit-basics/what-reit)

A REIT is a real estate fund where a minimum number of investors couple their money together to purchase property when it otherwise would not have been possible.

REIT’s are exceptionally diverse:

A REIT combines investor capital to purchase property for everyone in the investment group.

Profits are split according to the investment of each party and the REIT manager will take a 1-3% managing fee.

While REIT’s must be managed by the REIT management, which means you would not be responsible for managing the property, it would allow you to own property without all of the risk being placed on one or two investors and it would allow you to buy property when you don’t have the funds to purchase by yourself.

Why does this matter?

It matters because if you do not have the necessary capital to buy property you can still own property by combining investor’s funds with your own to purchase property using a REIT.

It also matters because if you are not experienced with real estate you will see how the REIT’s managers will manage the property yourself, which means in the future you will have a lot more real estate experience by viewing the management technique of the REIT manager.

As you can see in the chart below, in the long term, REITs increase at a rapid pace, allowing investors who do not have the necessary capital to purchase properties on their own, to get started in the real estate market and earn significant rate of returns.

13. Gaining Favor with Affluent People

Hard money lenders are always looking to make more money.

If you are in need of investor capital then working at a hard money company may be the best decision you can make.

If you can find deals that prove to be solid investment properties, the hard money investor may invest that you work for or the the company may invest in your deals.

At the end of the day a party investing in hard money loans does so to make money.

ex Property in Ventura:

If you presented the lender with a great investment opportunity you could be on your way to your first deal.

That’s not all.

In addition to potentially be able to close your real estate deals, working at a hard money company will teach you a significant amount about the financial business which as you already know is directly connected to the real estate market.

How does this benefit you?

It benefits you in two major ways.

- The first way it benefits you is you will definitely find an investor who wants to invest in property.

- The second way it benefits you is you are learning the mortgage business and connecting yourself with lifetime partners who have a significant net worth, which can help all your future deals.

How did this strategy directly benefit me?

My background in real estate actually began with a career in the mortgage business.

Without my experience in mortgages, many of the original property purchases my team and I invested in would not have been possible.

Because I was well connected with many prominent private lenders, I always had someone who could assist me in funding my deals or at the very least point me to people who had money to invest.